Spring is almost here, and with the warmer weather comes a much-needed invitation to do a little spring cleaning inspired by the famed organizer, Marie Kondo. While we can’t help you organize your closets or decide if your old photographs spark joy, we do have a few helpful tips for cleaning up your finances.

Spring cleaning your finances is a great way to start fresh for the year. And what could bring more joy than a clean slate and a carefully planned budget? Below, we’ve gathered seven tips to help you get the most out of your financial spring cleaning.

Dust off your budget

If you have been slacking on your budget so far this year, now is a great time to reset your priorities. Your budget is your best tool for tracking your spending habits and seeing ways that you could improve your spending and savings. Whether you prefer to write out your budget or use a budgeting app, it’s important to set up a system and stick with it. If you haven’t succeeded in the past with a written budget, try a financial software or a mobile app like Mint or Acorns to build some accountability.

Check your credit report

You should check your credit report at least once a year to make sure your credit is in good standing. It’s also important to do an annual check to ensure that there aren’t any inaccuracies on the report. While you’re checking the report, you can also figure out ways to improve your finances in the coming year.

To check this off your list, visit

Annual Credit Report

for a free credit report. This service offers a free credit report every 12 months and offers tips on how to protect your identity and review your credit.

Unsubscribe

While you’re reviewing your finances, take a closer look at which subscription services aren’t serving you. Remember that recurring subscription you keep meaning to cancel? Now is a great time to end that relationship!

Consider how often you use Netflix, Hulu, HBO or other services like monthly meal prep boxes or beauty boxes and balance that with the amount you want to budget for those services each month.

Fine tune your 401K

Spring is a great time to dive into your investment accounts. A comprehensive review of your financial goals and portfolio will help you figure out if you are contributing enough to your 401(k). You can also fine tune your portfolio to adjust to the current market.

You might be surprised to see that your 2018 year-end statement shows a negative return. According to

Consumer Reports

, stocks dropped in the fourth quarter of 2018 and the market bounced back just a bit in January. This is fairly common, but it is a helpful reminder that it’s important to keep track of your portfolio so you can make any adjustments to your plan when you see changes that you aren’t comfortable with.

Recharge your retirement savings

While you are in the financial planning mindset, why not prepare for the future by considering a

retirement plan

? Whether your goal is to retire soon or to start saving early for your retirement later in life, a retirement savings plan can help you get on the right track. Best of all, preparing for the future with a retirement plan is much easier than you think!

Shred it

Throughout the year, it can be easy to let your important files and financial documents pile up. To get the most out of spring cleaning, you should be getting rid of excess paperwork in your home. This applies to all those grocery store receipts from 2001 and the pile of papers that have overtaken a corner of your desk.

As you go through your paper files, create digital copies of all your important documents. Scan all your important files and be sure to back up to an external hard drive for good measure. Once everything is digitized, send all that excess paper straight through the shredder. Clearing your desk of these files is an excellent way to start fresh and feel in charge of your finances.

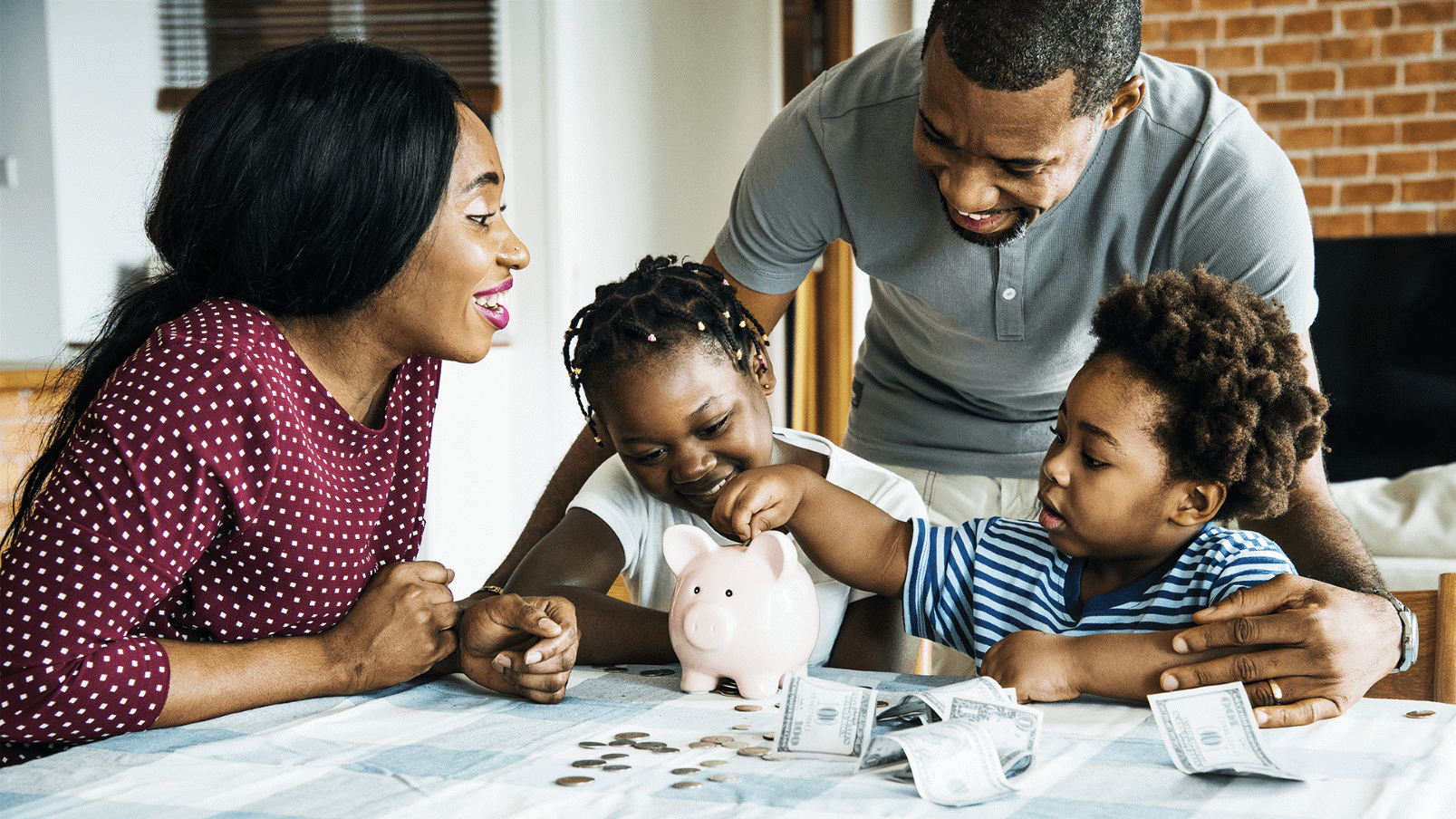

Get life insurance

Did you know that getting life insurance can help you improve your finances, get peace of mind about your financial future, and protect your home and family? End your financial spring cleaning on a high note by getting life insurance – the process is simple, and there are options for every budget.

- If you have young children,

term life insurance

protects your child’s future for as little as $2 a day.

- If you are a new homeowner,

mortgage protection insurance

protects your family in the event you pass away, or if you become diagnosed with a critical illness or disability and are unable to pay the mortgage.

- If you are

planning for retirement

, choosing an IUL or Annuity can provide financial security and guarantees.

We are here to make sure that you and your family are protected throughout your journey. Give us a call today to get started or use our online form to

request a quote

. Check getting life insurance off your list and enjoy the feeling of financial organization and protection with life insurance customized to your needs.